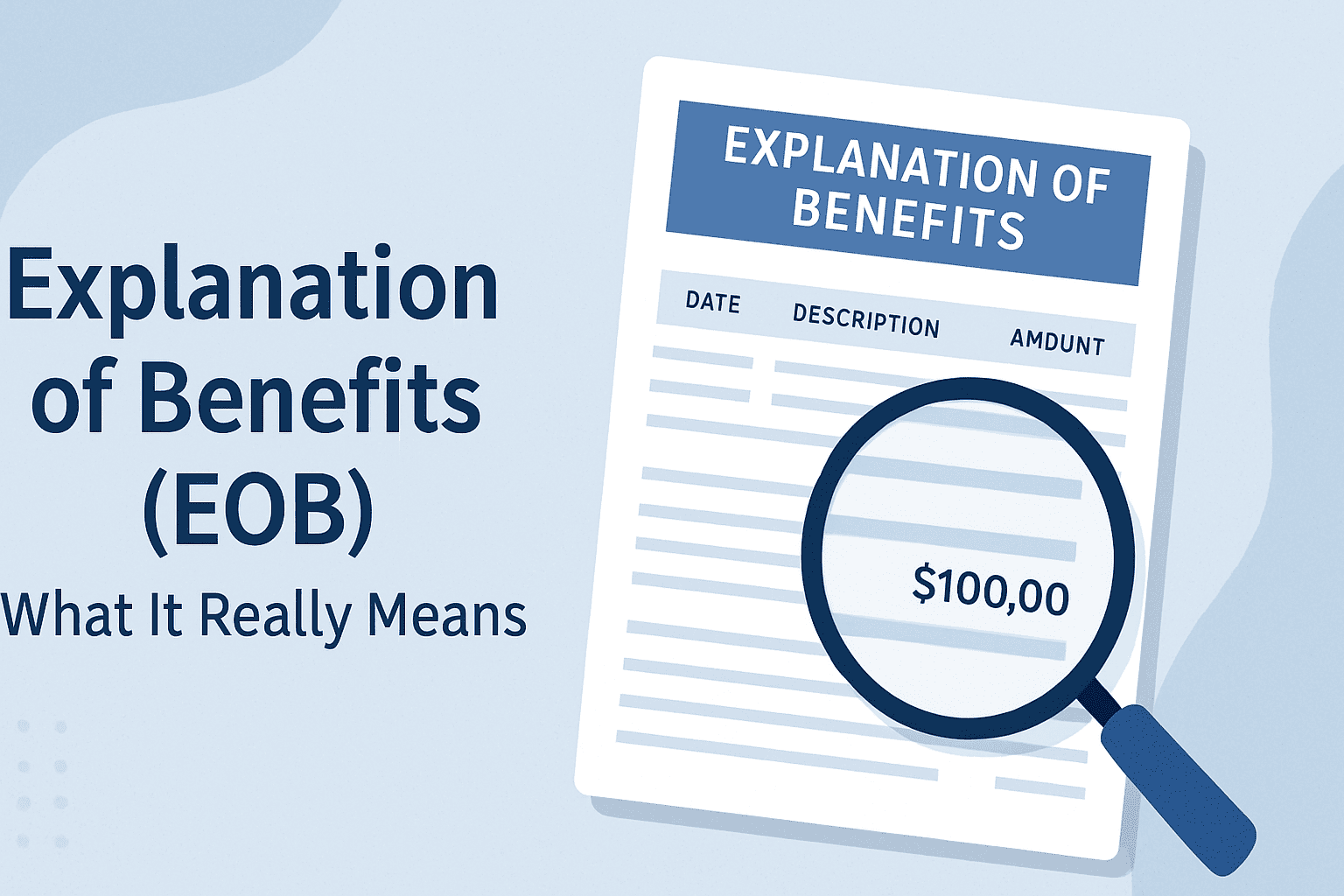

Explanation of Benefits (EOB): What It Really Means

Introduction: Why EOBs Confuse So Many Patients

If you’ve ever opened a letter from your insurance company after a doctor’s visit and thought, “Wait, I still have to pay this?”, you’re not alone. This document — called an

Explanation of Benefits (EOB) — is one of the most misunderstood parts of the medical billing process.

In this guide, we’ll break down what an EOB really means, why it matters, and how small practices can use this tool to improve transparency with patients.

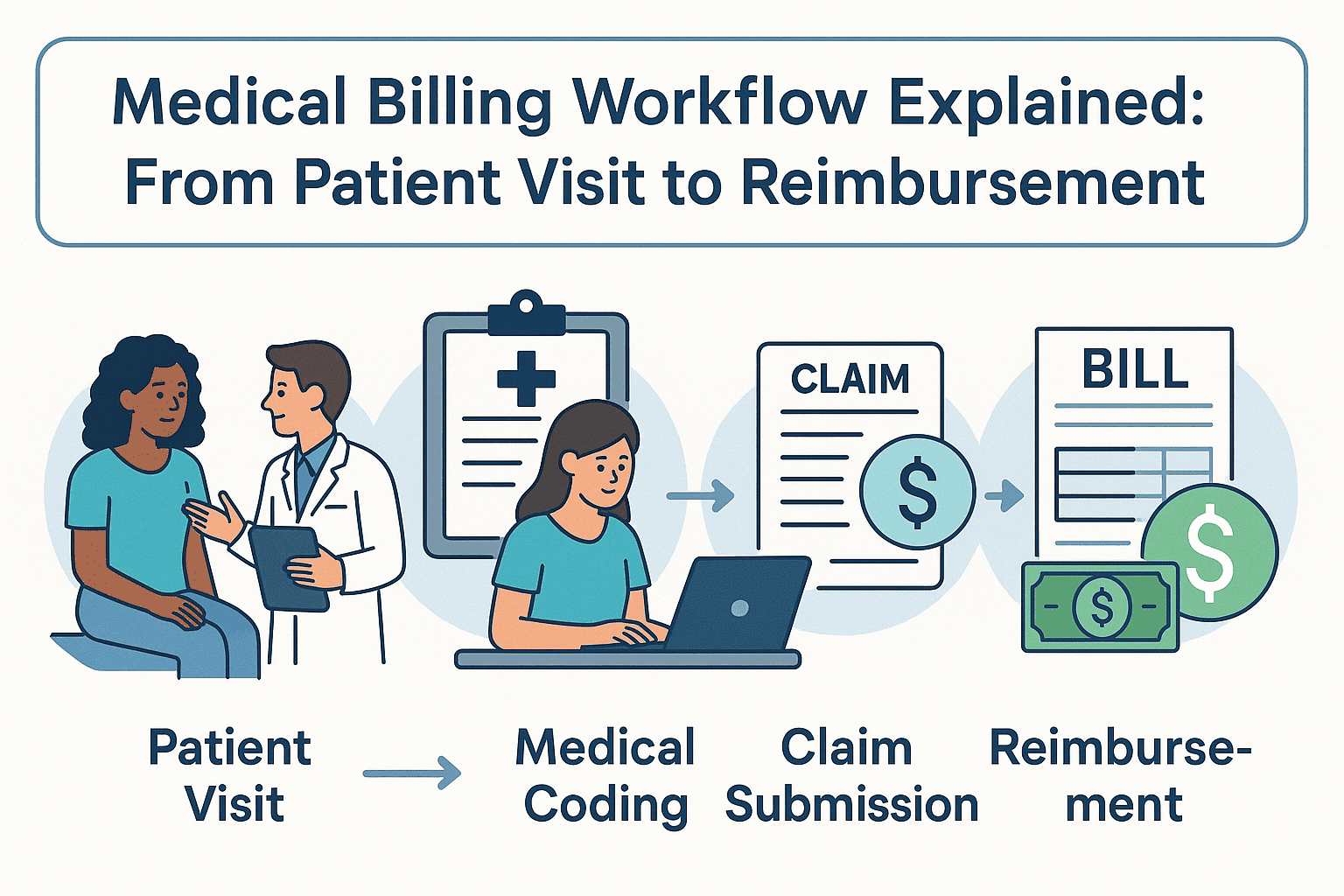

What Is an Explanation of Benefits (EOB)?

An EOB is a statement sent by your health insurance provider after a healthcare service is processed.

It

is not a bill — it’s an informational summary showing:

- The services performed

- What your provider charged

- What your insurance covered

- Any amount you may owe to the provider

Key Parts of an EOB

While EOB layouts vary by insurance company, most include the following sections:

Section

What It Tells You

Patient Information

Name, date of service, and provider details

Services Provided

CPT or ICD-10 codes, procedure descriptions

Amount Billed

The provider’s original charge

Allowed Amount

The negotiated rate insurance will pay

Insurance Payment

How much your plan covered

Patient Responsibility

Your copay, coinsurance, or deductible

Remarks/Notes

Additional clarifications or denial reasons

Common Reasons Patients Misunderstand EOBs

Patients often confuse an EOB with a bill because:

- The layout looks like an invoice — with numbers in bold.

- Insurance language can be full of abbreviations and codes.

- It lists an “Amount You Owe” without explaining payment instructions.

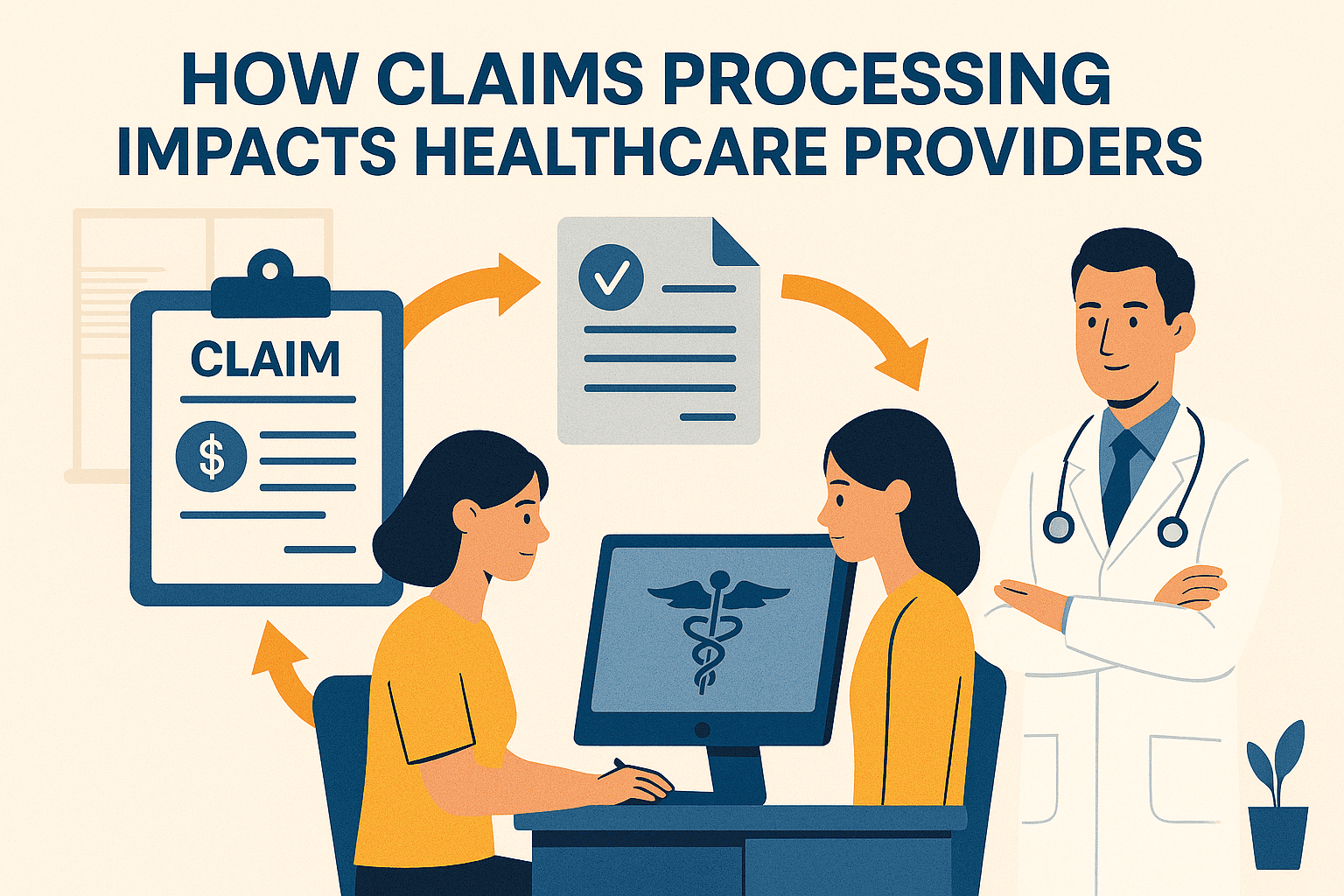

For small practices, unclear EOB explanations can lead to:

- More billing-related phone calls

- Delayed payments from patients

- Frustration that affects patient satisfaction

How Small Practices Can Help Patients Read EOBs

Clear communication about EOBs can improve collections and trust. Best practices include:

- Providing a quick reference guide for reading EOBs

- Highlighting “This is not a bill” in patient communications

- Offering billing consultations for high-cost services

- Using patient portals to link EOBs with billing records

(Related: Medical Billing for Small Practices)

EOB vs. Medical Bill — The Key Difference

EOB

Medical Bill

Sent by insurance company

Sent by provider or billing company

Explains what insurance covered

Requests payment from the patient

Includes codes & claim details

Lists actual amount due

No payment action required

Payment action required

Why EOB Accuracy Matters

A mistake on an EOB can lead to incorrect patient balances or claim denials.

Practices should:

- Verify CPT & ICD-10 codes before claims submission

- Follow up on discrepancies immediately with insurers

- Keep documentation of all communications for appeals

Final Takeaway

An Explanation of Benefits is a valuable tool for both patients and providers — if it’s understood correctly. By helping patients interpret their EOBs, small practices can reduce confusion, speed up payments, and improve overall satisfaction.

If your practice struggles with billing transparency or wants to improve patient payment timelines, outsourcing medical billing can streamline the process and ensure EOB accuracy from the start.