Superbill in Medical Billing: Definition, Uses & Best Practices for California Clinics

Introduction: Why Superbills Still Matter

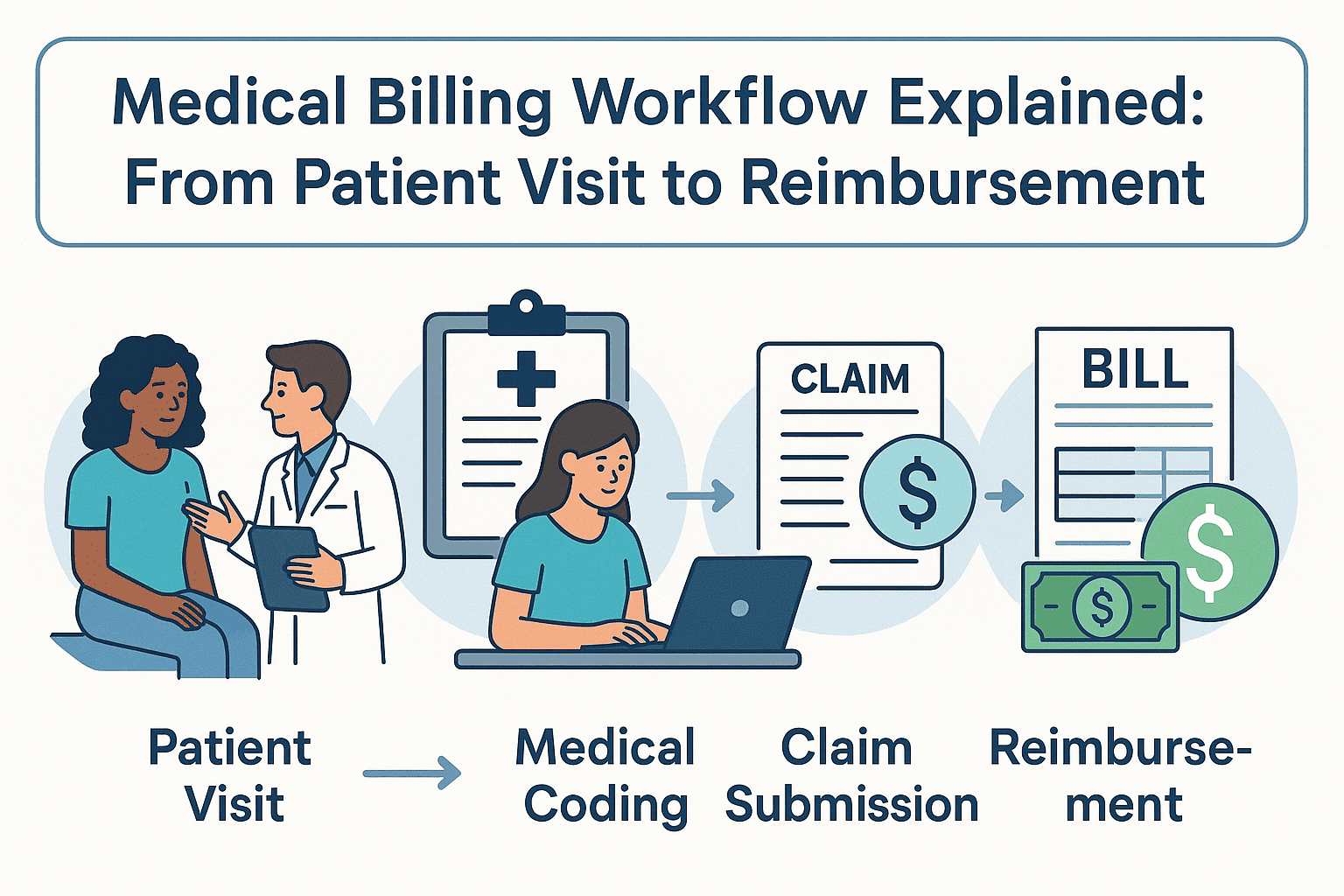

Even with advanced billing software and electronic health records, the superbill remains a cornerstone in the medical billing process. For many small and specialty practices in California, it’s the bridge between patient care and accurate insurance reimbursement.

Used correctly, a superbill ensures faster payments, fewer denials, and better compliance. Used inconsistently, it can slow down cash flow and frustrate both providers and patients.

What Is a Superbill?

A superbill is a detailed, provider-generated document listing all services provided during a patient visit — along with their corresponding CPT (Current Procedural Terminology) codes and ICD-10 diagnosis codes.

It’s not a bill to the patient. Instead, it’s a claims-ready document used for insurance reimbursement — either submitted directly by the provider or given to the patient for self-submission.

Medical Billing Superbill Sections

- Provider Information: Name, address, NPI number, tax ID

- Patient Information: Name, date of birth, insurance details

- Date of Service: The exact day care was provided

- CPT Codes: Identifies the procedures or services performed

- ICD-10 Codes: Identifies the medical necessity of services

- Charges: Amount billed for each service

- Provider Signature: Verifies the accuracy of the record

(Related:

What Is ICD-10?)

Why Practices Still Rely on Superbills

Even in 2025, superbills remain relevant for:

1. Out-of-network claims — patients need them to get reimbursed.

2. Specialty practices — such as dermatology, mental health, neurology, and internal medicine, where precision coding is critical.

3. Small clinics — without fully automated billing workflows.

4. Transition periods — when switching billing systems or credentialing providers.

(Related: Medical Billing Compliance)

The Risks of Inconsistent Superbill Use

Failing to complete or standardize superbills can cause:

• Claim denials due to missing or incorrect codes

• Delayed reimbursements requiring time-consuming follow-up

• Compliance issues that could trigger audits

For example, a single missing CPT code can lead to a complete claim rejection — even if the service was valid and necessary.

Best Practices for Using Superbills Effectively

• Use a standardized template across all providers

• Train staff in proper CPT and ICD-10 coding

• Double-check entries before claim submission

• Integrate with billing software to auto-generate claims

• Keep organized records for compliance and audits

(Related: Medical Billing for Small Practices)

Superbill vs. Itemized Bill

Superbill

- Lists CPT & ICD-10 codes

- Used for insurance claims

- Sent to insurer or patient for claim filing

- Focuses on claim accuracy & compliance

Itemized Bill

- Lists services in plain language

- Used for patient payment

- Sent directly to patient

- Focuses on financial charges

How Medical Billing Services California Improve Superbill Accuracy

For California-based clinics, managing superbills in-house can be time-consuming and error-prone. By partnering with a professional provider like Valley Medical Billing Services California, you can:

- Reduce coding and documentation errors

- Ensure claims are submitted quickly and correctly

- Improve cash flow with faster reimbursements

- Stay fully HIPAA compliant

If your practice wants to save time and improve billing accuracy, our team is here to help you create and process superbills that get results.

Final Takeaway

A superbill isn’t just paperwork — it’s the foundation of a smooth billing cycle. By standardizing how they’re created, ensuring coding accuracy, and integrating them into your billing workflow, you can reduce denials and get paid faster.