How to Read a Medical Bill: A Patient and Admin Guide to Understanding Charges

Reading a medical bill shouldn't require a medical degree, yet many patients and even admin staff find them hard to understand. This guide explains

how to read a medical bill clearly, so you know what you’re being charged for and why—and how to avoid overpaying or getting lost in billing errors.

Why Medical Bills Are So Confusing for Patients and Staff

A common frustration patients express is:

“Why am I getting billed after already paying at the clinic?”

“What does this CPT code even mean?”

For admin staff, explaining vague charges or denied claims without full context leads to tension, especially during high call volumes. Miscommunication slows down payment collections and lowers patient satisfaction.

Understanding

medical bill terminology helps solve both patient confusion and front-office stress.

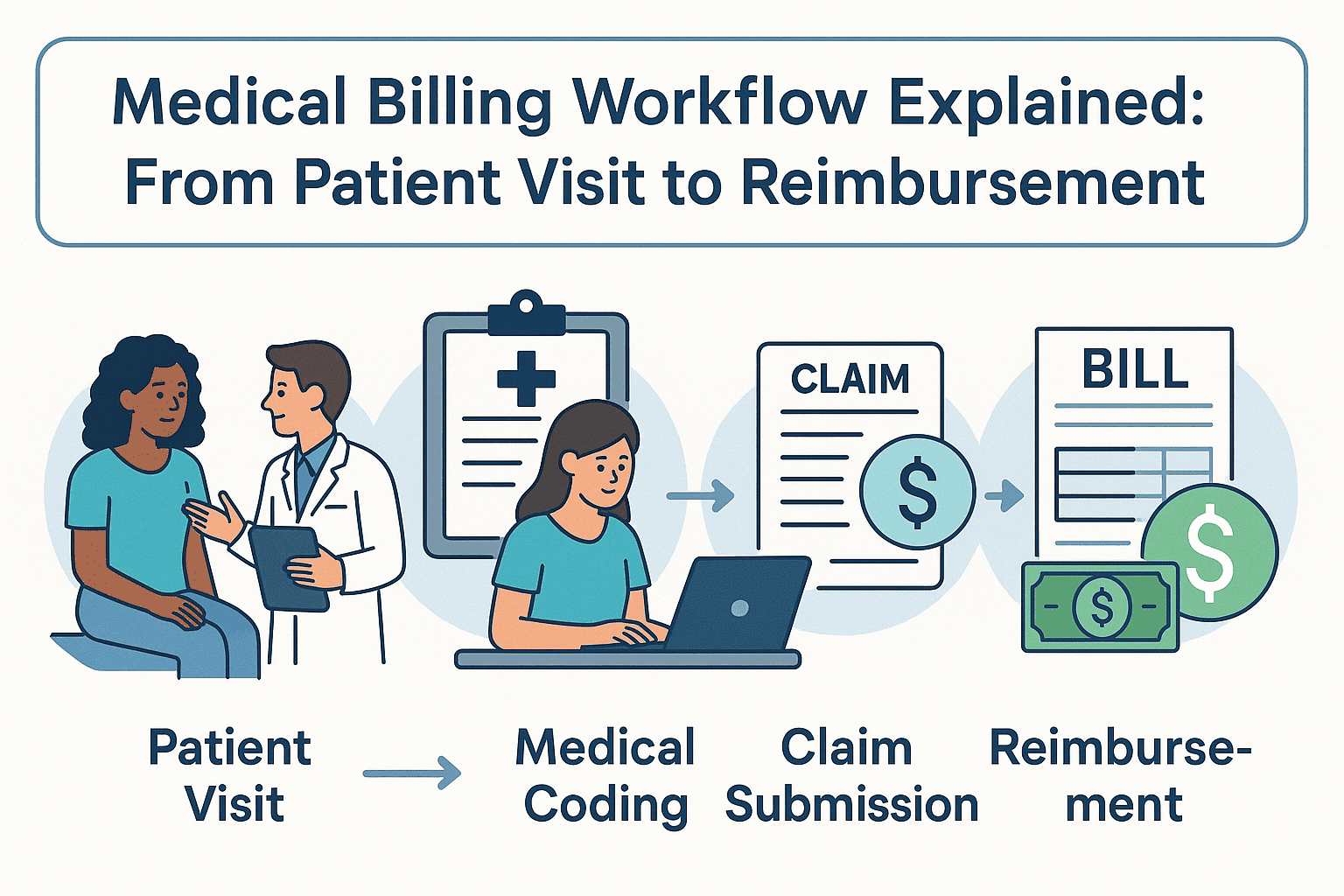

How to Read a Medical Bill: Line-by-Line Breakdown

Let’s walk through how to read each part of a standard medical bill, so both patients and staff can confidently understand the charges.

1. Patient Information and Service Dates

Start by confirming the basics: patient name, provider, and date of service. Errors here could mean you're reviewing the wrong bill entirely.

2. Understanding CPT Codes on Medical Bills

Every medical bill includes

CPT codes—Current Procedural Terminology. These are standard codes that describe services like office visits, lab tests, or procedures. Patients may not recognize them, but they’re essential for decoding services and insurance claims.

Tip for admin staff: Use your billing software to explain CPT codes in plain English, especially for frequently asked codes like 99213 (office visit) or J1885 (injection).

3. Billed Amount vs. Allowed Amount: What's the Difference?

- Billed Amount: What the provider charges.

- Allowed Amount: What your insurance agrees to pay.

The gap between these amounts is often adjusted, denied, or passed to the patient based on coverage and deductibles. This is where most confusion begins.

4. How Insurance Payments and Adjustments Work

This section shows what your

insurance provider paid, what they adjusted (or wrote off), and what’s left for you. Compare this to your

Explanation of Benefits (EOB) for accuracy. Discrepancies here are often due to authorization issues or out-of-network care.

5. Understanding Patient Responsibility in Medical Billing

This final section shows what the patient owes. If something seems off—a denial, duplicate, or unusual charge—it’s worth digging into.

What to Do When a Medical Bill Looks Wrong

It’s estimated that over 80% of medical bills contain at least one error. Whether you're a patient or a clinic manager, here’s what you should do:

- Request an itemized bill. This shows each service and corresponding charge, not just totals.

- Compare with your EOB. Ensure services and amounts match what your insurer reported.

- Contact the billing department directly. Don’t rely solely on front desk or reception—ask to speak with someone from billing or collections.

Common CPT Billing Codes Patients Ask About

Understanding a few common codes can help you identify unnecessary or duplicate charges:

CPT Code | Description

-----------|--------------------------------------------

99213 | Established patient office visit

80050 | General health panel (lab work)

J1885 | Ketorolac injection (non-opioid pain)

These codes are often misunderstood and lead to billing disputes if not explained clearly.

When to Consider Help with Medical Billing

If billing is a constant challenge in your clinic—or you’re a patient dealing with multiple unclear bills—it's worth exploring professional help. Many providers use

Medical Billing Services Near Me

to manage claim denials, clarify patient balances, and improve collection rates.

FAQs: What People Also Ask About Medical Bills

How do I read a medical bill from my provider?

Start by checking patient information, CPT codes, billed vs. allowed amounts, and compare it to your Explanation of Benefits (EOB). If something looks off, request an itemized bill.

Why did my insurance not cover a medical bill?

Possible reasons include using an out-of-network provider, not meeting your deductible, or lack of prior authorization. Contact your insurer for detailed reasons.

Can patients dispute medical charges?

Yes. You can appeal insurance denials, request billing reviews, and even negotiate payment amounts—especially if you're uninsured.

What's the difference between an EOB and a medical bill?

An

EOB is a statement from your insurer explaining what was covered. A

medical bill is from your provider, showing what you owe after insurance adjustments.

Final Thoughts

Learning

how to read a medical bill gives patients more control and helps admin staff provide better service. By breaking down codes, charges, and responsibilities, you can reduce billing stress—and avoid paying more than you should.

And if your clinic’s billing process still causes confusion, it might be time to work with experienced

medical billing services to simplify patient communication and speed up collections.